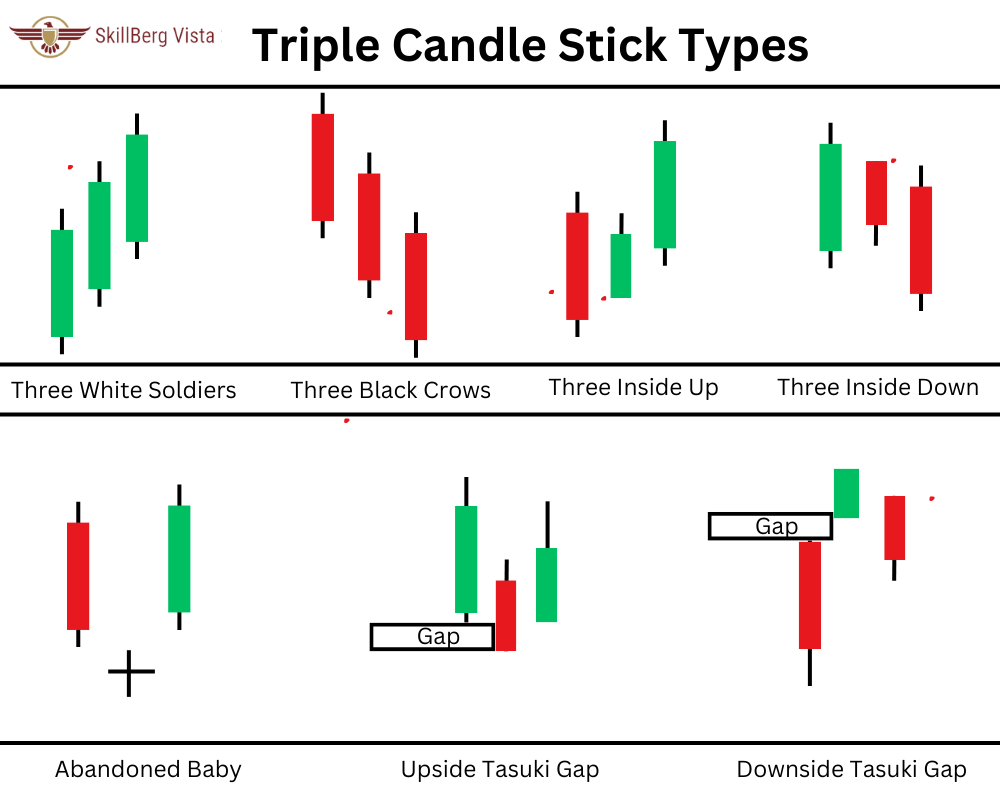

Triple candle stick patterns involve three consecutive candlesticks and are often used in technical analysis to signal potential trend reversals or continuations. Here are three notable triple candlestick patterns:

- Three White Soldiers:

- The Three White Soldiers is a pattern signaling a potential bullish reversal after a downtrend.

- It involves three consecutive long and bullish candles.

- Each candle opens within the previous one’s body and closes near its high, showing robust buying pressure and hinting at a trend reversal.

- Three Black Crows:

- The Three Black Crows is a bearish reversal pattern usually seen at the top of an uptrend.

- It comprises three consecutive long and bearish candles.

- Similar to the Three White Soldiers, each candle opens within the previous one’s body, but here, they close near the low, indicating strong selling pressure and a potential trend reversal.

- Three Inside Up:

- The Three Inside Up is a bullish reversal pattern occurring after a downtrend.

- It involves three candles:

- The first is a bearish candle.

- The second is a small-bodied candle completely within the first, suggesting a potential reversal.

- The third is a bullish candle closing above the first’s high, confirming the trend reversal.

- Three Inside Down:

- The Three Inside Down is the bearish counterpart to the Three Inside Up, happening after an uptrend.

- It consists of three candles:

- The first is a bullish candle.

- The second is a small-bodied candle within the first, indicating a potential reversal.

- The third is a bearish candle closing below the first’s low, confirming the trend reversal.

- Abandoned Baby:

- The Abandoned Baby is a reversal pattern, bullish or bearish.

- For a bullish pattern, it often appears at the bottom of a downtrend with three candles.

- The first is bearish, the second is a doji showing uncertainty, and the third is a bullish candle with a gap up, suggesting a potential reversal.

- For a bearish pattern, the sequence is reversed, occurring at the top of an uptrend.

- Upside Tasuki Gap:

- The Upside Tasuki Gap is a bullish continuation pattern seen during an uptrend with three candles.

- The first is bullish, the second is bearish with a gap down, and the third is a bullish candle opening within the second’s body, indicating a potential continuation of the uptrend.

- Downside Tasuki Gap:

- The Downside Tasuki Gap is a bearish continuation pattern observed during a downtrend with three candles.

- The first is bearish, the second is bullish with a gap up, and the third is a bearish candle opening within the second’s body, suggesting a potential continuation of the downtrend.

Read More: 8 Double Candle Stick Types You Must Know